Email marketing for credit unions is a reliable way to engage members, promote services, and support growth. With the huge amount of emails consumers get every day, credit unions must take a clear and deliberate strategy to capturing attention.

This guide offers practical tips to boost email performance. You’ll learn how to increase open rates, encourage member action, and strengthen relationships. Key areas include audience segmentation, subject line improvement, and automation to save time and improve results.

Table of Contents

Create an Engaged Member List for Effective Email Marketing for Credit Unions

An effective email marketing strategy starts with a permission-based list of members who are interested in receiving your messages. Grow the list through voluntary sign-ups and follow regulations such as CAN-SPAM in the U.S. and GDPR internationally. This approach ensures compliance and helps build member trust.

For more strategies on making the most of your subscribers, check out 13 easy ways to profit from your email list.

A successful email marketing campaign starts with a well-segmented, engaged audience. Here’s how to grow your list the right way.

Opt-in Forms on Website & Mobile App

Add sign-up forms to high-traffic pages like your homepage, blog, and mobile app dashboard. The easier it is to subscribe, the more people will participate.

In-Branch Sign-Ups

Train staff to promote email subscriptions during member interactions. Offer incentives like exclusive financial tips, member-only discounts, or early access to promotions.

Use Social Media

Use your Facebook, LinkedIn, and Instagram profiles to promote email signups. Clearly clarify what members receive, such as timely financial suggestions, essential updates, or unique offers.

Double Opt-in Process

Always send a confirmation email when someone subscribes. This helps:

- Keep your list clean and engaged;

- Reduce bounce rates;

- Improve inbox placement.

Segment Your Audience to Improve Campaigns

Generic emails don’t cut it anymore – especially in finance. When every member has different needs, sending the same message to everyone means most of them will ignore it. The solution? Market segmentation.

By grouping members based on their life stage, financial interests, and engagement levels, credit unions can send emails that actually matter to the recipient. Here’s how:

Tailor Messages by Life Stage

For college students and recent grads, focus on:

- Smart ways to handle student loans;

- Building credit with their first card;

- Essential budgeting basics.

Encourage young professionals to consider financing choices for significant purchases such as cars and homes, as well as sensible strategies to balance saving with their rising financial obligations.

Provide retirees with advice on making retirement funds endure, obtaining reliable returns through CDs, and key estate planning issues.

Match Content to Financial Needs

Members looking at borrowing possibilities will benefit from specific information on house loans, personal financing solutions, and refinancing options to minimize existing costs.

Those who are interested in saving respond well to information regarding accounts with competitive returns, certificate deposits, and practical guidance for creating financial safety nets.

Share opportunities to create wealth with investment-minded individuals, such as retirement accounts, professional advice services, and relevant market insights.

Adjust Approach by Engagement Level

Your regular users stay connected when you provide useful account activity notifications, reward program benefits, and special member-only opportunities.

For members who’ve gone quiet, try personalized incentives, quick feedback requests, or gentle reminders about valuable services they may have forgotten.

The magic happens when your messages feel specifically crafted for each recipient – that’s when you’ll see open rates climb and member relationships deepen.

Marketers that want to stand out in packed inboxes understand the importance of relevance. Research suggests that emails with tailored subject lines have a 26% higher open rate, whilst segmented campaigns may generate up to 760% more income.

Craft Compelling Subject Lines & Preheaders

Your subject line is what makes members decide to open your email or ignore it. Skip the generic announcements – you need subject lines that grab attention and show real value.

What works?

- Be straightforward: Uncertain or extremely creative language is less successful than a sentence like “Members-Only Mortgage Rate Drop”;

- Don’t be too long: To ensure complete display on mobile devices, try to keep the character count around 50;

- Exhort action by saying, “Rate Increase Coming Friday – Lock In Today,” since it is relevant and helpful;

- Pose pertinent queries: “Want a Reduced Auto Loan Interest Rate?” speaks directly to the interests of members.

And don’t forget the preheader – that sneak peek of text after the subject line. It’s prime real estate to reinforce your message or, worse, waste the opportunity with “View this email in your browser”.

Pro tip: Avoid spammy triggers (“FREE!” “Act NOW!”) unless you want your email banished to the junk folder. Instead, focus on what actually matters to members: What’s in it for them?

Nail this, and you’ll not only boost opens – you’ll build trust, one inbox at a time.

Optimize Email Content for Engagement

Getting your email opened is just half the battle – what really matters is what happens next. Your email content needs to grab attention, keep readers interested, and push them to take action.

The secret? Clear communication, real value, and strong calls-to-action that tell members exactly what to do next.

Here’s how to write emails that convert:

Make It Personal

Start with their name (“Hey Sarah, your mortgage pre-approval is waiting!”) – it instantly makes your message feel more relevant and trustworthy.

Cut the Fluff

Nobody reads long paragraphs. Use concise words, bullet points, and strong headers to highlight important information. Make it simple for skimmers to understand the point quickly.

Show, Don’t Just Tell

Enhance your emails with on-brand visuals, simple charts, and clickable buttons (which perform better than boring text links). A little visual refinement may go a long way.

Tell Them What to Do Next

Use straightforward CTAs that leave no room for confusion, like:

- “Start Your Application”;

- “See Your Rate in 2 Minutes”;

- “Schedule Your Free Session”.

Pro tip: Place your main CTA where eyes naturally go – either right at the top or bottom of your email.

When your content is this focused, members won’t just read – they’ll respond.

Automate Email Campaigns for Efficiency

Email automation enables credit unions to deliver targeted communications at the optimal time – without doing the hard work. By implementing smart triggers based on member behavior, you may strengthen connections while saving critical staff time.

Essential Automated Email Sequences:

- Welcome Series – Introduce key services like online banking and loans;

- Abandoned Applications – Remind members to complete loan or account forms;

- Birthday & Anniversary – Send appreciation messages or special offers;

- Loan Education – Share simple guides on mortgages, auto loans, and more.

Automation not only increases productivity, but it also guarantees that members receive the correct message at the right time, resulting in higher satisfaction and retention.

A/B Test for Continuous Improvement

A/B testing allows credit unions to examine various email elements to see what works best for their members.

Credit unions may enhance the effectiveness of their email marketing by testing variants that increase open rates, click-through rates, and conversions.

What to test:

Subject Lines

Experiment with personalized approaches (“Sarah, your member-exclusive deal is here!”) versus value-driven messaging (“Slash your loan interest by 1.5% – act now!”) to identify which drives higher open rates.

Timing

Test sending emails at different times – such as early morning versus late afternoon, or weekday versus weekend – to pinpoint when members are most responsive.

Call-to-Action (CTA) Positioning

Assess whether placing CTAs near the beginning, middle, or end of an email leads to more clicks and conversions.

Design & Formatting

Compare visually rich emails (with graphics and banners) versus clean, text-focused layouts to see which type gets more interaction.

Reviewing A/B test results regularly provides useful data to refine email strategies over time.

Ensure Mobile-Friendly Emails

With over 60% of emails viewed on mobile devices (Litmus), credit unions must emphasize mobile optimization to provide a consistent member experience. If communications do not appear adequately on smartphones, engagement might suffer, and members may lose faith in the institution.

Because many consumers read emails while on the go, campaigns must load quickly, show properly, and promote prompt answers.

Mobile Optimization Tips:

Responsive templates are non-negotiable

Your email needs to automatically resize for any device. Most email platforms like Mailchimp offer these – use them. Then test on actual phones, not just desktop previews.

Your email needs to automatically resize for any device. Most email platforms like Mailchimp offer these – use them. Then test on actual phones, not just desktop previews.

Short and sweet subject lines

Mobile screens cut off long subjects. “2.9% Auto Loan Rate” works better than “Special Limited-Time Offer on Vehicle Financing Options.”

Thumb-friendly buttons

Make action items impossible to miss with large, colorful buttons. Apple’s standard of 44×44 pixels ensures even clumsy thumbs can tap accurately.

Readable text sizes

14px font minimum for body copy. Anything smaller forces squinting and quick deletions.

Quick scanning beats long scrolling

Divide text into bite-sized pieces with clear titles. If you must offer extensive information, utilize expandable sections.

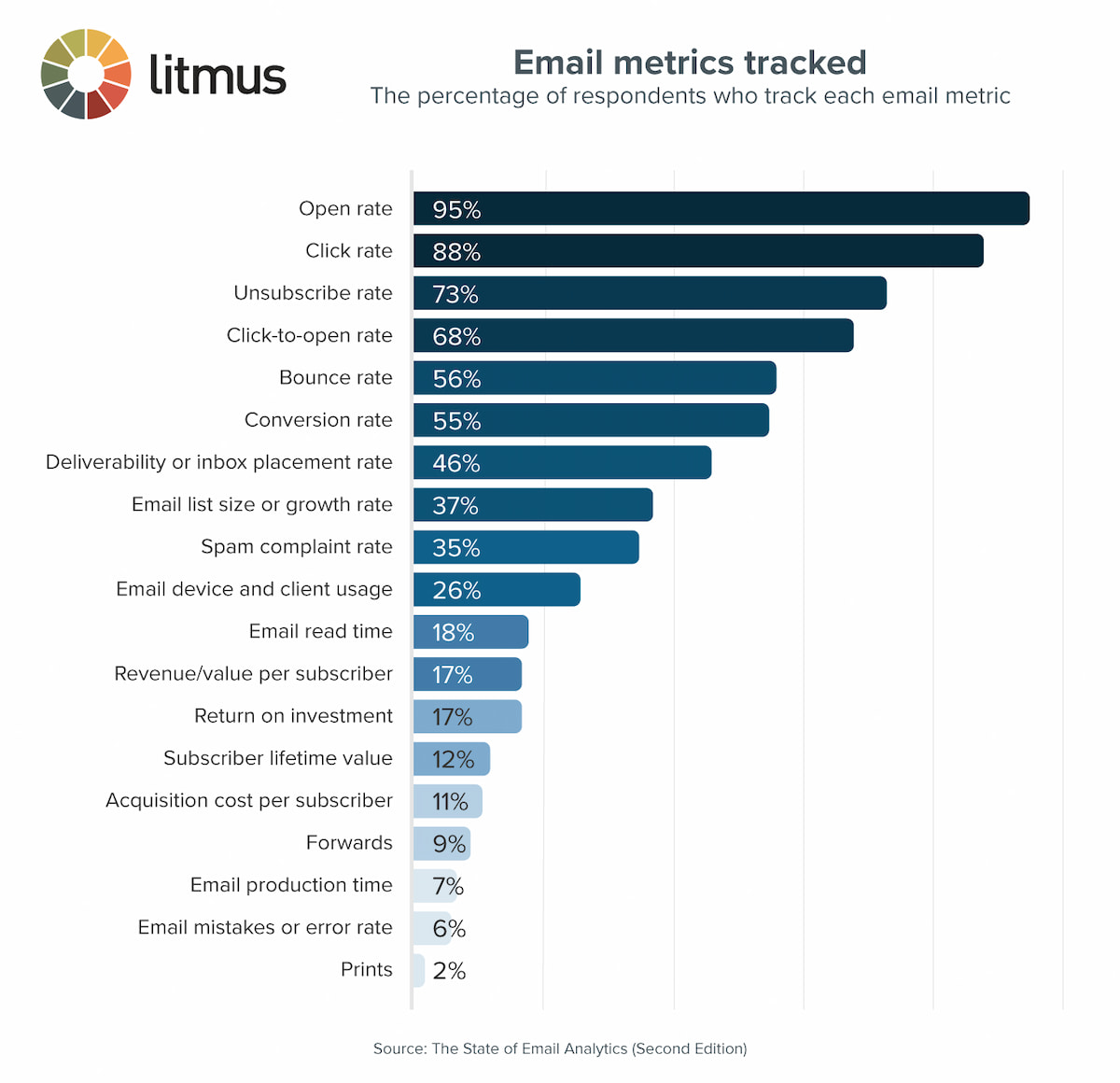

Monitor Key Metrics & Adjust Strategies

Numbers don’t lie – they show exactly what’s working in your email campaigns and what needs fixing. By keeping an eye on key metrics, you can double down on successful tactics, fix what’s underperforming, and get better results over time.

The 5 Email Metrics That Actually Matter:

Open Rate (Aim for 20-30%)

This tells you if your subject lines are hitting the mark. Low opens? Try:

- Personalization (“John, your exclusive rate is inside”);

- Urgency (“24 hours left to claim your bonus”);

- Emojis (when appropriate).

Click Rate (Target 2-5%)

Measures how compelling your content and CTAs are. If clicks are weak:

- Move your main button “above the fold”;

- Test different phrasing (“Get Started” vs. “Claim Your Offer”);

- Make sure your email delivers on the subject line’s promise.

Conversions (The Bottom Line)

Great opens/clicks, but few applications? Fix the friction:

- Add one-click application links;

- Shorten your forms;

- Ensure landing pages match the email’s offer.

Bounce Rate (Keep under 2%)

High bounces hurt deliverability. Fix by:

- Cleaning your email list quarterly;

- Removing hard bounces immediately;

- Running re-engagement campaigns for inactive addresses.

Unsubscribes (Below 0.5% is healthy)

Sudden jumps mean something’s off. Send exit surveys asking:

- “What made you unsubscribe?”

- “How often would you prefer emails?”

- “What content would you find valuable?”

Pro Tip: Use Mailchimp for email statistics and Google Analytics to track what happens when you click. Review your statistics on a frequent basis and adjust your strategy; your future self will thank you when those metrics start to rise.

Remember that little data-driven changes lead to big benefits over time. To establish which adjustment caused the needle to change, test one at a time.

Comply with Financial Industry Regulations

Email marketing for credit unions requires more than simply amazing content; it must also be compliant. Financial rules might be complex, but adhering to them protects your members and keeps your credit union out of trouble.

Understanding CAN-SPAM Requirements

The CAN-SPAM Act extends beyond basic spam suppression. It requires including:

- Your physical address in every email;

- A clear, working unsubscribe option.

These aren’t just legal formalities – they show respect for your members’ preferences.

Protecting Member Data (GLBA & GDPR)

Financial data requires extra protection. The Gramm-Leach-Bliley Act (GLBA) and GDPR (for international members) mean you must:

- Clearly explain how you’ll use member information;

- Implement strong security measures for sensitive data.

Ensuring Email Accessibility

ADA compliance helps all members access your content, including those using screen readers. Simple fixes make a big difference:

- Add alt text to images;

- Use clear, readable fonts and colors;

- Maintain a logical email structure.

Compliance Strengthens Relationships

Regulations may appear to be restrictive, yet they really help to foster the growth of trust. When members perceive that you handle their information properly and speak openly, they are more likely to engage with your emails, which is what matters.

Show Real Member Stories to Build Trust

People trust real experiences more than sales pitches. Sharing member success stories makes your services feel more relatable and credible – helping hesitant members take action.

How to use member stories in emails:

Savings Wins

*”How [Member Name] Saved $200/Month on Their Auto Loan”*

→ Include numbers: “By refinancing with us, Sarah lowered her rate from 5.3% to 3.9% – saving $2,400 a year!”

Service That Stands Out

“Why Members Love Our Mortgage Process”

→ Add a quote: “‘The team explained everything clearly – no confusing bank talk!’ – Mark R., First-Time Homebuyer”

Quick Video Stories

→ Embed short clips (under 60 sec) of members sharing their experience.

→ Use captions for viewers who watch without sound.

Full Success Story Emails

Break down a member’s journey, like:

- Problem: “Stuck with high-interest credit card debt”;

- Solution: “Consolidated with our 4.5% personal loan”;

- Result: “Paid off debt 2 years faster than expected”.

Why does it work: Real stories demonstrate – rather than simply tell – how you assist members in winning.

Conclusion

Email marketing for credit unions is an excellent strategy to strengthen member ties and promote development. Campaigns that use segmentation, customization, automation, and continuous testing can generate improved engagement and conversion rates.

Put these techniques into action right now to improve the effectiveness of your email marketing and measure your success.