Wells Fargo is one of the largest banks in the US and the world. It boasts 8,000 locations around the country and a massive network consisting of over 13,000 machines. If you’re a Wells Fargo customer, you may need to access your routing number to perform certain types of transactions.

Why do you need the Wells Fargo routing number?

People come across the need to locate the routing number of Wells Fargo for many reasons. Here are some of the most common.

- You need the Wells Fargo routing number to deposit a paycheck

- You’ll need to have the routing number to set up a direct deposit

- You’ll also be able to use the routine number of many other financial transactions you do with the Wells Fargo account.

Regardless of the reason why you are searching for it, we can help you to locate it. We’ve compiled all the routing numbers by state to make it more convenient and listed a few other ways to get it.

How to locate the Wells Fargo routing number?

There are three main methods available for Wells Fargo customers to find their routing number. Of course, you don’t have to use all of them – just choose the one that’s most convenient for you.

Find the Wells Fargo routing number by state

The first method to locate the Wells Fargo routing number is to look it up based on the state you live in. However, this may not always be effective because the routing number is tied to the state where you opened your account.

If you’ve moved recently or move often then make sure you’re using the routing number from the proper state. If you’re not sure, you may want to use one of the other methods on this list.

STATE | WELLS FARGO ROUTING NUMBER |

|---|---|

ALABAMA | 62000080 |

ALASKA | 125200057 |

ARIZONA | 122105278 |

ARKANSAS | 111900659 |

CALIFORNIA | 121042882 |

COLORADO | 102000076 |

CONNECTICUT | 21101108 |

DELEWARE | 31100869 |

FLORIDA | 63107513 |

GEORGIA | 61000227 |

HAWAII | 121042882 |

IDAHO | 124103799 |

ILLINOIS | 71101307 |

INDIANA | 74900275 |

IOWA | 73000228 |

KANSAS | 101089292 |

KENTUCKY | 121042882 |

LOUISIANA | 121042882 |

MAINE | 121042882 |

MARYLAND | 55003201 |

MASSACHUSETTS | 121042882 |

MICHIGAN | 91101455 |

MINNESOTA | 91000019 |

MISSISSIPPI | 62203751 |

MISSOURI | 113105449 |

MONTANA | 92905278 |

NEBRASKA | 104000058 |

NEVADA | 321270742 |

NEW HAMPSHIRE | 121042882 |

NEW JERSEY | 21200025 |

NEW MEXICO | 107002192 |

NEW YORK | 26012881 |

NORTH CAROLINA | 53000219 |

NORTH DAKOTA | 91300010 |

OHIO | 41215537 |

OKLAHOMA | 121042882 |

OREGON | 123006800 |

PENNSYLVANIA | 31000503 |

RHODE ISLAND | 121042882 |

SOUTH CAROLINA | 53207766 |

TENNESSEE | 111900659 |

TEXAS | 111900659 |

TEXAS - EL PASO | 112000066 |

UTAH | 124002971 |

VERMONT | 121042882 |

VIRGINIA | 51400549 |

WASHINGTON | 125008547 |

WASHINGTON, D.C. | 54001220 |

WEST VIRGINIA | 121042882 |

WISCONSIN | 75911988 |

WYOMING | 102301092 |

Many states even share the same routing number. This may be due to the nature of banks and how they grow. Over the years, Wells Fargo acquired many banks in order to expand its reach, and instead of rebuilding the existing infrastructure, it just created more on top of it.

The results are reflected in routing numbers – amongst other things.

Find the Wells Fargo routing number in a personal check

The second method of locating the routing number for your Wells Fargo account is to take a look at your checkbook. If you don’t have a check, you can skip this method and take a look at the alternative way below

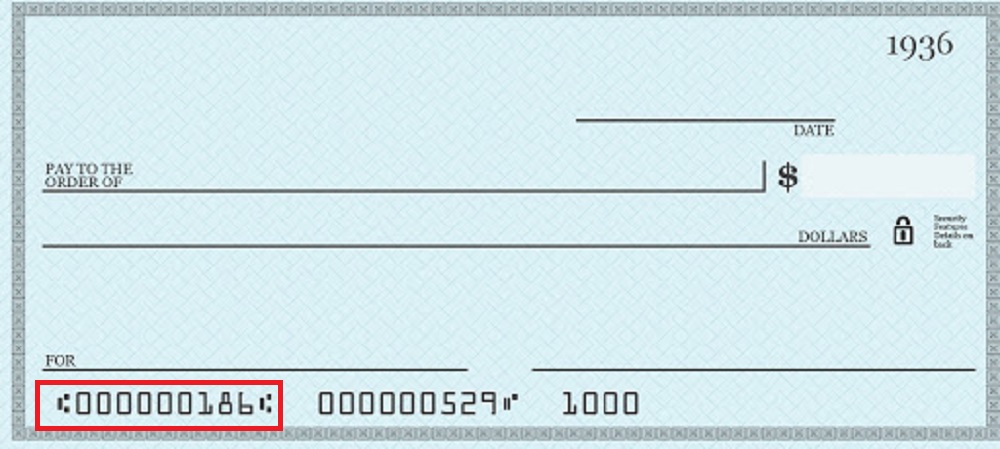

Pull out one of your checks and look at the bottom edge. You’ll see multiple groupings of numbers like in the image below.

The first nine digits, which have been outlined with a red box in the image above, are your routing number. This is your routing number for Wells Fargo as well as any other bank that issues checks. It’s a standardized format to prevent confusion.

The number right next to your routing number is your account number.

Fun fact, the first four digits of a routing number correspond to the routing symbol of the Federal Reserve which. The first two digits correspond to the exact Federal Reserve Bank the transaction will flow through. The second group of four digits is the bank’s ABA institution number given by the Federal Reserve. The last digit is for automated checking and reducing errors.

Call customer support of Wells Fargo

This may be the least attractive option because it’s the most time-consuming. Sometimes, you don’t have a choice, and reaching out to support is the only avenue available.

You can visit the official Wells Fargo website and use an online form. Fill in the type of account you have and the state it was opened. The tool will show you the routing number. It’s surprisingly fast.

The other method is to call Wells Fargo customer support. Even though they’re available 24/7, it may take a bit of time to get through to a real human being. They have a huge number of customers so this is to be expected.

You may want to go this route if you can’t remember the state you were in when you opened your account. They’ll ask you a few security questions and give you the information you need without too much hassle.

ACH vs Wire transfer routing number

The routing numbers presented above are referred to as ABA routing numbers and are used for ACH transfers. There’s a different set of numbers for wire transfers but it’s a single number for domestic transactions and another one for international transactions. That makes it much easier.

Wire transfers are faster but they do cost money while ACH transfers are free but take a few days longer. In the end, it’ll depend on how much money you’re sending and whether or not you’re in a hurry for the funds to arrive.

- The domestic wire transfer number is121000248

- The international wire transfer number – also known as SWIFT code – is WFBIUS6S

Final words

As an entrepreneur, there are many times where you may need to do an ACH or wire transfer. Finding a routing number is one of the easier steps. It’s important to double-check all the information you have so that it’s correct.

If you accidentally send it to the wrong account, it’s almost always nonrefundable. Just be careful with how and where you send your funds and you’ll be fine.