The insurance lead generation process is changing. Traditional marketing methods are becoming less effective as consumers grow more informed, privacy-aware, and less responsive to generic sales tactics. Among the most effective approaches are email marketing tips for insurance leads, since email remains one of the strongest channels for growth.

However, it must be used with a clear strategy, as bulk messages and simple quote requests are no longer enough to get attention or build trust.

To succeed in 2025, insurance agencies need a data-driven email strategy that delivers real value and positions them as trusted advisors rather than just policy sellers. The eight strategies in this article provide email marketing tips for insurance leads, offering a practical plan for generating new prospects and guiding them through the long insurance buying process until they become loyal clients.

For a broader look at how to build a complete system for attracting and converting prospects, see how to create and execute a successful lead generation strategy.

This article will explain how to apply stronger personalization, structured lead nurturing, and updated technology to maintain a reliable pipeline for this year.

Table of Contents

8 Email Marketing Tips for Insurance Leads

Below are eight proven email marketing tips for insurance leads that help agencies attract quality prospects, nurture them effectively, and increase conversions.

Hyper-Personalization Beyond the First Name: The Era of the “Segment of One”

Personalization in 2025 is far more than inserting [First Name] into a subject line. It’s about delivering the right message to the right person at the right moment in their life based on the data they’ve provided and the behaviors they’ve exhibited.

Insurance is inherently personal. It’s about protecting one’s health, family, home, and livelihood. A generic message about “great rates” is meaningless compared to an email that acknowledges a subscriber’s recent life event, like buying a home or having a baby.

Putting this into practice:

Leverage Life Event Triggers

This is one of the most effective tools. Connect your CRM with your email marketing platform to trigger automated sequences based on specific signals.

- New Homeowners: Partner with services like DataTree or use public records to identify new purchases. Trigger a series on homeowners’ insurance, valuable add-ons like flood insurance, and tips for new homeowners;

- New Parents: Target users who have signed up for parenting blogs or purchased baby items (via data partnerships or disclosed information). Send emails about life insurance, health insurance for the new dependent, and wills/trusts;

- Recent Retirees: This audience needs guidance on Medicare Advantage plans, final expense insurance, and annuities.

Behavioral Targeting

Track how leads interact with your emails and website.

If a lead repeatedly clicks on links about auto insurance but ignores life insurance content, your automation should tag them as an “Auto Insurance Hot Lead” and serve them more auto-specific content, testimonials, and offers.

If a lead downloads a guide on “Cyber Liability for Small Businesses,” a follow-up email should not offer a generic business owner’s policy (BOP) but should delve deeper into cyber threats and the specifics of your cyber coverage.

Dynamic Content

Use platforms that support dynamic content blocks. This allows you to create one master email, but the content inside changes based on the subscriber’s tags. For a lead interested in auto insurance, the email shows a CTA for an auto quote. For a life insurance lead, the same email shows a life insurance calculator.

Example: Instead of “John, Get a Free Quote Today!”, try “John, Congrats on the new home in Springfield! Here are 3 coverage gaps new homeowners often miss.”

Value-First Lead Magnets: Ditch the Generic Quote Form

The standard “Get a Free Quote” call-to-action is a weak value proposition. It asks for personal information (a big ask) in exchange for a sales conversation (not always a desirable outcome for the lead). In 2025, you must lead with immense value.

Why it Works for Insurance: People are naturally wary of insurance. They find it complex and confusing. By offering genuine education first, you position yourself as an expert and a helper, not just a salesperson. This builds trust, which is the currency of insurance sales.

How to Apply This Strategy

Stop asking for an email address and start earning it. The key is to create lead magnets that are so genuinely helpful and solve such a specific problem that people are eager to trade their contact info for the value you’re providing.

Interactive Calculators

Move beyond PDFs. Offer an interactive “Life Insurance Needs Calculator” or “Retirement Income Calculator” hosted on your site. The user inputs data, gets a personalized result, and then you can ask for their email to send them a detailed PDF report of their calculation.

Comprehensive Checklists and Guides

- “The Ultimate Home Inventory Checklist for Insurance Claims”;

- “The Small Business Owner’s Guide to Navigating General Liability vs. Professional Liability”;

- “Pre-Retirement Checklist: Navigating Medicare and Health Insurance at 65”.

Webinar Series

Don’t just host a sales pitch. Pick a topic that causes real anxiety for your clients—like understanding the fine print on their roof warranty or how AI is actually used in claims processing. A live webinar lets you answer questions directly and show you know your stuff, building trust before you ever talk about a sale.

Improving the claims processing experience has become a major differentiator for insurance providers and contractors, as policyholders consistently cite slow, confusing claims as their biggest source of frustration after a loss occurs. When improving the claims processing through technology implementation or workflow optimization, companies should focus on transparency and communication—customers care less about backend efficiency gains and more about knowing exactly where their claim stands at any given moment.

Educational content around improving the claims processing timeline resonates strongly because it addresses the anxiety clients feel when they’re displaced from their homes or dealing with property damage and uncertain about when resolution will come.

Example: Instead of a boring “Get a Quote” button, your offer becomes, “Grab our Free Guide: 10 Questions to Ask Before Renewing Your Business Insurance.” They get immediate value, and asking for a quote afterwards feels like a natural next step, not a sales pitch.

Stop “Welcoming” and Start Nurturing (Your Secret Sales Weapon)

Sending one welcome email isn’t a strategy. To turn a new lead into a client, you need a planned series of emails that builds trust and provides value over a few weeks.

Insurance isn’t an impulse buy. People research, think about it, and wait for their current policy to expire. A good email sequence keeps your agency fresh in their mind during this long decision-making process.

How to Implement it

Design a 5-7 email sequence that automatically deploys over 2-3 weeks when someone signs up for your lead magnet.

- Email 1 (Immediate): “Thank you for downloading! Here’s your guide.” (No selling);

- Email 2 (Day 2): “Did you find the section on [Key Topic] helpful?” Offer an additional, bite-sized tip related to the guide;

- Email 3 (Day 4): Social proof. “Here’s how we helped [Similar Client] solve [Problem mentioned in guide]”;

- Email 4 (Day 7): Authority building. “A common question we get is [FAQ]. Here’s a detailed answer in a short blog post/video”;

- Email 5 (Day 12): Soft offer. “Whenever you’re ready, we can help you review your current policies to identify any gaps. No pressure, just a friendly conversation”;

- Email 6 (Day 18): Case study. A more detailed story of a client you helped, focusing on the emotional outcome (peace of mind, saved money, a covered claim);

- Email 7 (Day 25): Direct CTA. “Are you reviewing your policies this month? Let’s schedule a quick 15-minute consultation”.

This sequence provides value at every step, gently guiding the lead toward a conversation.

The Power of Video Integration: Build Trust Face-to-Face

Let’s talk about video. There’s simply no better way to build trust without being in the same room. A short, genuine video can create a connection, show you care, and get people to actually pay attention to your message.

This is a game-changer for insurance because this entire business runs on trust. When someone can see your face and hear you explain something complicated in plain English, it feels real. It transforms your agency from a faceless company into a group of people your clients can actually know and like.

Here are practical steps insurance agencies can take to apply this approach effectively right now.

Personalized Video Messages

Use tools like Loom or Vidyard to send short, personalized video emails. When a lead downloads a guide, send a 60-second video thank you. “Hi [Lead Name], I saw you downloaded our guide on X. I’m a big believer in this topic because… Let me know if you have any questions!”.

Explainer Videos in Emails

Embed short (under 90 seconds) videos directly in your emails to explain complex concepts: “What is a deductible?” “What does ‘umbrella’ coverage actually mean?” “A 60-second explanation of whole vs. term life”.

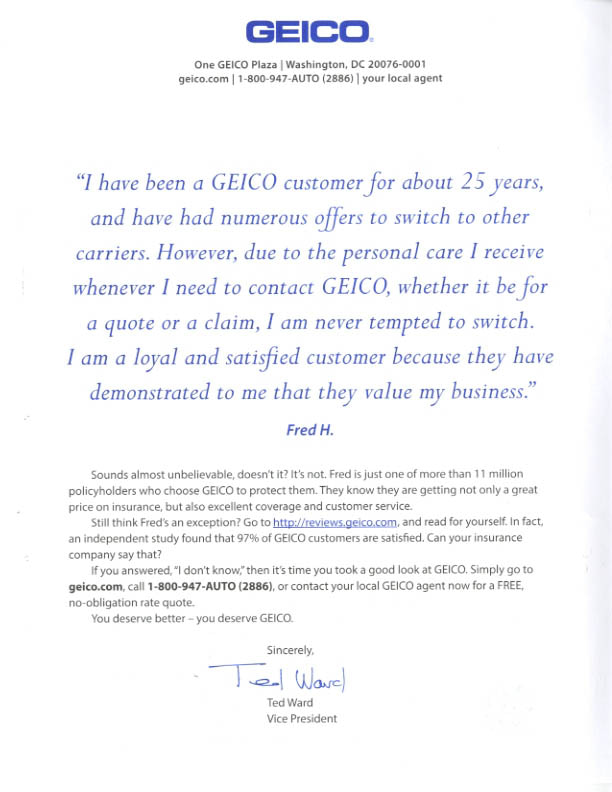

Claim Story Testimonials

The most powerful marketing tool in insurance is a well-handled claim. Get a satisfied client on video (with their permission) telling the story of their accident or loss and how your agency guided them smoothly through the claims process. This is pure gold and should be featured prominently in nurture sequences.

Example: The subject line: “A quick video answer to your question about roof coverage.” The email body: just the video and a simple line: “Hope this helps. Reply to this email if you’d like to discuss your specific situation.”

Interactive and Gamified Email Content

Static text is passive. Interactive content is engaging. It increases the time spent with your email and creates a memorable experience.

Why it Works for Insurance: It transforms a typically dry subject into something interesting and fun. It also provides you with valuable data on what your lead is interested in.

Here’s how agencies can put this strategy into practice.

Interactive Polls and Surveys

Embed a poll directly in your email. “For your auto insurance, what’s your biggest concern? A) High monthly premiums B) What happens after an accident C) Understanding what my policy actually covers.” This not only engages but also segments your audience based on their answer.

“Choose Your Own Adventure” Emails

Use interactive modules (supported by many modern ESPs) to let users click to choose what content they see next. “What would you like to learn about? [Button: Life Insurance] [Button: Saving on Auto Insurance] [Button: Protecting My Business]”.

Gamified Risk Assessments

Create a “How protected are you?” quiz. A series of questions about their assets, family status, and current coverage that culminates in a “Protection Score.” To see their full results and recommendations, they click through to a landing page, effectively qualifying themselves.

AI-Powered Optimization: From Subject Lines to Send Times

Artificial Intelligence is not a futuristic concept; it’s a practical tool available today to optimize every aspect of your email campaign.

Insurance marketing is all about timing and relevance. AI can sift through huge amounts of data to find subtle patterns we’d never see ourselves. This means you can stop wondering what works and start knowing what works, making sure your emails get opened and read.

Here is how to implement it.

Write Better Subject Lines

Use tools like Jasper or the features built into email platforms (like Brevo) to generate a bunch of subject line options. These tools can predict which ones will get the most opens and even run the A/B tests for you automatically.

Send Emails at the Right Time (For Each Person)

Stop sending everyone an email at 10 AM on Tuesday. AI can look at each individual’s habits and send your email exactly when they’re most likely to open it—whether that’s 7:32 PM on a Sunday or 11:06 AM on a Wednesday.

Improve Your Email’s Wording

Paste your draft into an AI tool and ask it to make the language clearer, more engaging, or simpler to understand. It’s like having a copy editor on call to sharpen your message.

Spot Leads Who Are Losing Interest

This is a big one. AI can analyze behavior to identify leads who have stopped opening your emails or clicking links. It flags these “going cold” leads for your sales team, giving them a chance to jump in with a personal phone call or email before it’s too late.

Data Privacy and Transparency as a Selling Point

With frequent data breaches and growing privacy concerns, being transparent and secure is a strong competitive advantage, especially in the sensitive financial area of insurance.

Why it Works for Insurance: You are asking for highly personal information. Explicitly stating how you will protect it and use it builds immediate trust and differentiates you from less scrupulous actors.

Here’s what to do to make this approach work for insurance leads.

Clear Value Exchange in Sign-up Forms

Don’t just have a tiny “View our Privacy Policy” link. Next to the submit button, state plainly: “We value your privacy. We will use your email to send you the guide you requested and occasional tips on protecting what matters most. You can unsubscribe at any time.”

Re-permission Campaigns

Regularly clean your list. Send an email to older segments: “We’re updating our records! Do you still want to receive our valuable insurance insights? [Yes, Keep Me Updated] [No, Unsubscribe].” This improves list health and ensures you’re only talking to engaged audiences.

Be GDPR/CCPA Compliant by Design

This part is mandatory. Use clear opt-in checkboxes (never pre-checked) and have a simple way for people to ask for their data or delete it. But don’t stop there—tell people you’re doing it.

A badge or a line that says “We are fully GDPR & CCPA compliant to keep your data safe” isn’t just fine print; it’s a reassurance that you’re a professional who can be trusted with their sensitive information.

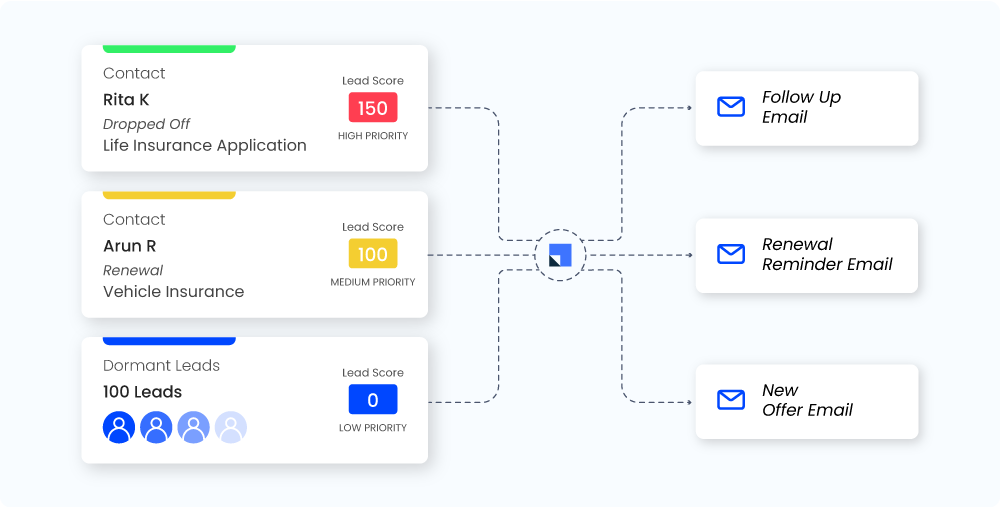

Advanced Segmentation and Reactivation Campaigns

Your entire email list is not one audience. Treating it as such is a recipe for low engagement. Advanced segmentation allows for surgical targeting, while reactivation campaigns rescue valuable leads from the brink of being lost forever.

Using a LinkedIn email finder can help you gather accurate contact information for your segmented audiences, ensuring your messages reach the right people at the right time.

Why it Works for Insurance: A 25-year-old renter needs a completely different message than a 55-year-old business owner. Segmenting allows for hyper-relevance. Furthermore, a lead that goes cold isn’t necessarily a “no”; they might just be “not right now.” A clever reactivation campaign can bring them back into the fold.

Steps to Apply

Segment Your List Meticulously:

- By Policy Type: Auto, Home, Life, Business, Medicare;

- By Lead Stage: New Subscriber, Nurturing, Quote Requested, Client;

- By Engagement Level: Hot (opens/clicks regularly), Warm, Cold (no opens in 90 days);

- By Demographic: Age, Location, Homeowner/Renter, Business Size.

Create a “Win-Back” reactivation sequence. For leads marked as “Cold,” run a specific campaign.

- Email 1 (Subject: Did we do something wrong?): “We noticed you haven’t been opening our emails lately. We hate to see you go! Could you take a quick survey to tell us how we can improve?” This shows you care and can provide feedback;

- Email 2 (Subject: Last chance to stay?): “This will be our last email if we don’t hear from you. We’d love to keep you informed with valuable content.”;

- Email 3 (Subject: A final gift from us): “Sorry to see you go. As a thank you for your past interest, here’s a link to our most popular resource anyway: [Link to Ultimate Guide]. No strings attached.” This final act of value can sometimes trigger a re-engagement out of sheer surprise and appreciation.

Conclusion

Email marketing for insurance in 2025 should not be treated as a one-way broadcast. It is a tool for consistent communication and building long-term relationships based on trust and expertise.

The focus of these eight strategies is to shift from pushing insurance products to providing useful information and reassurance. Well-structured emails can deliver value and establish credibility before a policy is even purchased. These approaches are practical email marketing tips for insurance leads, helping agencies build stronger relationships with prospects.

By applying personalization, clear value-driven content, structured nurturing, interactive elements, AI-driven insights, strong privacy practices, and thoughtful segmentation, an agency can turn its email list into a reliable source of growth. This approach reduces the need for aggressive lead chasing and instead encourages prospects to engage and convert into loyal clients.